By Rubina Q. Karim of EdwardJones

Everybody wants financial security when he or she retires, and many Canadians are counting on employer pension plans to provide that security. But there’s a growing possibility that your pension may not provide the retirement income you need.

There is a growing trend toward defined contribution pension plans. These are registered pension plans that specify the employee and employer contributions but not the amount the employee will receive at retirement. Payout amounts from these plans are based on the returns earned by their investments. If the investments perform well, you could have more income than you expect; if they underperform, you could be left short.

There is a growing trend toward defined contribution pension plans. These are registered pension plans that specify the employee and employer contributions but not the amount the employee will receive at retirement. Payout amounts from these plans are based on the returns earned by their investments. If the investments perform well, you could have more income than you expect; if they underperform, you could be left short.

Defined benefit pension plans are different from defined contribution plans. In a defined benefit pension plan, the employee knows, in advance, how much he or she will receive at retirement, and contributions are based on the employee’s salary and length of service. Defined benefit plans were once the norm in Canada. However, most new pension plans are of the defined contribution type, and many existing defined benefit plans are being converted.

Members of defined contribution plans can usually choose how to invest their plan contributions. Participants are provided with tax-sheltered investment options ranging from conservative to higher growth. Their contributions are pooled with those of other plan members and invested by professionals.

Companies prefer defined contribution plans because employers aren’t required to pay fixed benefits when investments perform poorly, as is the case with defined benefit plans. This shifts risk from the employer to the employee. For example, those who choose a growth option that invests largely in equities could suffer if the stock market has a few down years immediately before they retire.

Even defined benefit plans have risks. Many of these pension plans are underfunded and could fail to meet obligations to employees. This can be because of poor investment returns or the employer’s inability to make contributions.

How can you protect yourself from the possibility of less pension income than you’ll need? The best strategy is to have other sources of retirement income.

Registered Retirement Savings Plans (RRSPs): If you belong to a pension plan, your yearly RRSP contribution room will be reduced by a pension adjustment. However, you may still be able to build considerable RRSP wealth before retirement. That wealth can provide additional income.

Tax-Free Savings Accounts (TFSAs): Consider taking advantage of the Tax-Free Savings Account, which can provide you with tax-free income during retirement. Every Canadian age 18 or older can contribute up to $5,000 per year to a TFSA.

Non-registered investments: If you have used your available RRSP and TFSA contribution room, consider holding your investments in a taxable investment account. Although your investment income is taxable, capital gains and dividends from certain Canadian companies may provide you with some tax advantages. Remember, however, that dividends can be increased, decreased or eliminated at any point without notice.

If you are interested in ways to boost your retirement savings, meet with an Edward Jones advisor to see which options best fit your needs and goals.

Member Canadian Investor Protection Fund

Edward Jones, Member CIPF.

The above article is provided by Rubina Karim, a financial advisor with Edward Jones in White Rock, BC. She welcomes your questions and comments at 604-542-2788

Fortified, we drove 64kms(40miles) south of Portland, to McMinnville, and the Evergreen Aviation and Space Museum and the Captain Michael King Smith Educational Institute, which is dedicated in memory of the museum founder, Capt. Michael King Smith, who was killed in 1995 in an auto accident and was also the son of Evergreen International Aviation’s founder, Delford M. Smith.

Fortified, we drove 64kms(40miles) south of Portland, to McMinnville, and the Evergreen Aviation and Space Museum and the Captain Michael King Smith Educational Institute, which is dedicated in memory of the museum founder, Capt. Michael King Smith, who was killed in 1995 in an auto accident and was also the son of Evergreen International Aviation’s founder, Delford M. Smith.

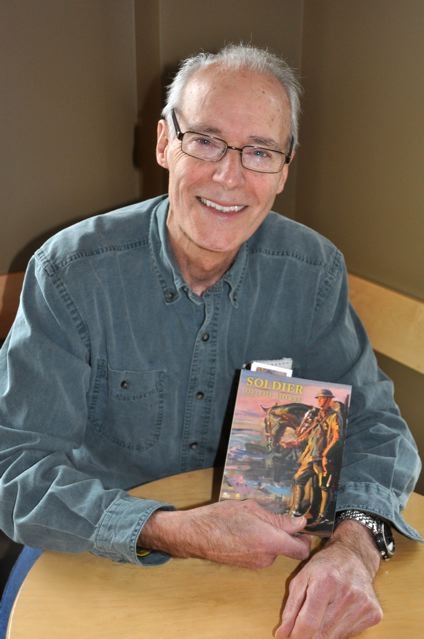

When Bob Mackay retired he traded drafting legal briefs for crafting books. Soldier of the Horse, Mackay’s first fiction novel, arrived on his desk last week.

When Bob Mackay retired he traded drafting legal briefs for crafting books. Soldier of the Horse, Mackay’s first fiction novel, arrived on his desk last week.